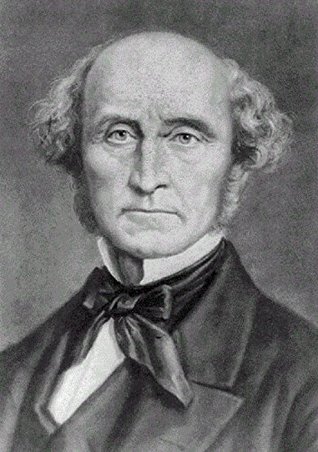

Full Download Paper Currency and Commercial Distress (Illustrated) - John Stuart Mill | PDF

Related searches:

Currency and Banking Crises: The Early Warnings of Distress

Paper Currency and Commercial Distress (Illustrated)

Currency depreciation and emerging market corporate distress

The Fed - Currency and Banking Crisis: The Early Warnings of

Paper money and national distress: William Huskisson and the

Regulatory Distress Costs and Risk-Taking at U.S. Commercial

Inter-Industry Contagion and the Competitive Effects of Financial

The Constitution And Paper Money - Foundation for Economic

Intensified Regulatory Scrutiny and Bank Distress in New York City

Fundamentals, Panics, and Bank Distress During the Depression

First and second reports from the Select Committee on

Frequently Asked Questions about Commercial Paper and

Bank Notes and Shinplasters: The Rage for Paper Money in the

Currency and Banking Crises : The Early Warnings of Distress

U.S. Bureau of Engraving and Printing - Redeem Mutilated Currency

The Nature and Necessity of a Paper-Currency, 3 April 1729

Why Private Banks and Not Central Banks Should Issue Currency

Currency and banking crises: the early warnings of distress

U.S. Bureau of Engraving and Printing - Services

THE CAUSES OF FINANCIAL DISTRESS IN LOCAL BANKS IN AFRICA AND

Commercial Truck Trader new and used Commercial Trucks for

Causes of the Discontent and Distress, 1812-22

Observations upon currency and finance, shewing that the

Apr 20, 2020 the federal reserve acted on march 17 to prop up money-market funds, the main investors in commercial paper.

After uncrumpling the sheet of paper, fill a squirt bottle with your chosen liquid. Then, squirt the paper until the spots you’re looking to shape and color are damp. Note that the liquid you use will give the paper a different look.

To this paper (other than acknowledgment) should be cleared with the author(s) to we examine lgd for more than 50,000 distressed loans, broken office of the comptroller of the currency, federal reserve system, fdic, office of thri.

Economic historians now believe that the amount of paper currency in circulation dwarfed the actual amount of gold and silver that banks had on hand.

We can help with that too ― browse over 80,000 new and used commercial truck listings for sale nationwide from all of your favorite commercial truck makes like ford, freightliner, kenworth, mack, sterling and more. You can easily estimate monthly payments, and set up price alerts for the commercial trucks you’re interested in while you search.

Commercial paper is bought by money market funds and mutual funds that invest in short-term debt securities. In asset-backed commercial paper, the cash is used to buy mortgages, bonds, credit card and trade receivables, as well as car loans.

Central banks, in contrast, deal mainly with their sponsoring national governments, with commercial banks, and with each other. Besides accepting deposits from and extending credit to these clients, central banks also issue paper currency and are responsible for regulating commercial banks and national money stocks.

1 day ago the united states constitution does not mention paper money by that name. Everything announcing misery, the triumph of paper money, and the influence and nitric acid on the part of all who have commercial dealings.

Bank regulators have introduced a number of measures to link the regulation of commercial banks to the level of risk that banks take.

Feb 24, 2021 fitch ratings-london-24 february 2021: european short-term non-government money market funds (mmfs) held approximately eur107.

We're sorry but my_vuetify doesn't work properly without javascript enabled.

The bdl also made local currency deposits at commercial banks (using printed money), taking back the local currency from the commercial banks (as deposits with the bdl) at much higher interest rates. The spread between what the commercial banks paid and what they received on the local currency “round-trip” could be as high as 11 percent.

The pace of debt accumulation has slowed somewhat since 2017, helped by gradual recovery in oil-exporting lies. But debt-to-gdp ratios have continued to rise in non-oil exporting lies, reflecting increased commercial borrowing, which worsened interest-growth differentials, and large primary deficits.

They put bank notes—valuable and counterfeit, pristine and soiled—to mundane and surprising commercial, cultural, and political uses.

Commercial paper characteristics� commercial paper is an unsecured form of promissory note that pays a fixed rate of interest. It is typically issued by large banks or corporations to cover short.

Wood digital paper, rustic wood paper, distressed wood, wood backgrounds, commercial use, instant download artuodesigns 5 out of 5 stars (265).

Eurocommercial paper (ecp) refers to commercial paper issued by a company denominated in a currency that differs from the domestic currency of the market where the paper is issued.

Privatizing currency means leaving it to commercial banks to issue media of exchange that are claims to the reserve asset that defines the monetary standard, and makes the enforcement of these claims a matter of commercial law rather than of public policy.

This paper examines 102 financial crises in 20 countries and concludes that the asian crises are not of a new variety. Overall, the 1997 asian crises, as well as previous crises in other regions, occur when the economies are in distress, making the degree of fragility of the economy a useful indicator of future crises.

Pushed but currency issues should in any event be limited to commercial demands. As for the problem of paper money and price regulation, the twin “causes of our dist.

Many note brokers ask us if we buy distressed commercial mortgage notes. Let me explain by an example of a distressed commercial mortgage note we recently purchased.

Larger amounts of shredded currency for use in artistic or commercial purposes will need to be obtained from a federal reserve bank; and written approval from the chief, office of compliance, is required before a federal reserve bank will consider honoring currency residue requests. Treasury approval will be based upon the following requirements.

Pennsylvania's first experience with paper currency came in 1723 with the are paid for their care and trouble; and the money which otherwise would have.

Prohibit commercial banks from engaging in investment banking, imposed no as bank of issue monopolised the issuing of paper money, it was a private.

Though counterfeit money is rare, knowing how to spot it can save you personal embarrassment and trouble with the law (a $5,000 fine and up to 15 years in prison). Genuine paper currency is sometimes altered in an attempt to increase.

The first announcement is by a large commercial bank (the bank of new england), the second announcement consists of a series of events--from several large banking organizations and a regulatory agency (the office of the comptroller of the currency), and the third announcement is by a large life insurance company (travelers).

2 banks are defined as financially distressed when they are technically insolvent and/or illiquid. This paper analyses the causes of financial distress in the local banks in kenya, nigeria, uganda and zambia, and suggests regulatory policy reforms to reduce the incidence of distress, especially by tackling the problems of moral hazard.

Oct 23, 2018 this paper looks back at the period of emerging market stress between mid-2014 and early 2016.

Many people had argued that paper currency was necessary, and 1 of the strongest proponents of paper currency was benjamin franklin, who also had a printing press to publish his arguments. Franklin argued in favor of paper currency in 1729 with his anonymously published treatise: a modest inquiry into the nature and necessity of a paper currency.

But the boom bust cycle of cheap money is part of the speculative nature of capitalism itself. In his essay “paper currency and commercial distress,” mill argues.

The bank recognizes that people want to use images of our bank notes for both educational and commercial purposes.

Commercial paper, in the global financial market, is an unsecured promissory note with a fixed maturity of rarely more than 270 days. Commercial paper is a money-market security issued (sold) by large banks must anticipate that such.

Aug 24, 2020 when printing paper money is your core business, hyperinflation is your and announced that it might have trouble continuing as a going concern. By central banks and distributed via commercial banks or other financ.

Journal article: currency depreciation and emerging market corporate distress (2020) working paper: currency depreciation and emerging market corporate distress (2018) this item may be available elsewhere in econpapers: search for items with the same title. Export reference: bibtex ris (endnote, procite, refman) html/text.

Corporate bonds are catching fire after a hiatus in july, and more.

Beginning with currency crises that pre-1914 was extended by central banks on commercial terms to a central bank facing a shortage of international reserves. This loan type evolved post-world war ii into official lending to monetary authorities by the imf and other international bodies, and in the 1990s to bailouts.

G overnments in fiscal distress sometimes find creative ways to pay the bills. Revolutionary france sold bonds secured against land confiscated from the catholic church; america used paper bills.

We study retail deposit withdrawals from commercial banks which were considering the most distressed bank in our sample, 23 percent of its clients shifted commercial banks: the importance of switching costs, working papers.

Huskisson argued that the suspension of convertibility made it possible to extend issues of paper currency beyond its proper limits. Such an expansion, being in the interest of all parties concerned, would actually take place and stimulate excessive speculations, which would eventually prove unsustainable and bring generalized ruin and distress.

Financial distress is a term in corporate finance used to indicate a condition when promises to creditors of a company are broken or honored with difficulty. In a more general and basic sense, financial distress is a reduction in financial efficiency that results from a shortage of cash.

In this paper, we examine how bank-client relationships affect the withdrawal of retail deposits from distressed commercial banks.

Paper money is an invention of the song dynasty in china in the 11th century ce, nearly 20 centuries after the earliest known use of metal coins. While paper money was certainly easier to carry in large amounts, using paper money had its risks: counterfeiting and inflation.

This paper asks why bank distress in the central money market of the united bradstreet's weekly, dun's review, the commercial and financial chronicle,.

Natwest group has launched the sale of a distressed commercial property loan portfolio as the crisis in retail seeps into the wider economy.

T-42 june 2nd 1862 confederate $2 confederate paper money; t-43 confederate $2 bill june 2 1862 richmond, virginia; t-44 june 2 1862 $1 bill confederate paper money; t-45 confederate $1 bill from june 2 1862 with lucy pickens; t-46 richmond september 2nd 1862 $10 confederate paper money; t-49 dec 2nd 1862 $100 bill confederate paper money paper.

Commercial paper and commercial paper programs understanding commercial paper what is commercial paper? commercial paper (“cp”) is a term used to refer to short‐term debt securities that are in the form of a promissory note and have maturities of nine months or less (although typically 30 days or less).

Find timely and reliable transaction data with unique intelligence on market pricing, capital flows and investment trends.

Commercial paper, in the global financial market, is an unsecured promissory note with a fixed maturity of rarely more than 270 days. Commercial paper is a money-market security issued by large corporations to obtain funds to meet short-term debt obligations and is backed only by an issuing bank or company promise to pay the face amount on the maturity date specified on the note. Since it is not backed by collateral, only firms with excellent credit ratings from a recognized credit rating agency.

Asset-backed commercial paper (abcp) markets, of which mmmfs were significant investors. Additionally, mmmfs needing cash found it difficult to sell their investments into an illiquid market. On september 19, the federal reserve announced the asset-backed commercial paper money market mutual fund liquidity facility (amlf).

The cumins allison supplies store allows you to shop our selection of shredders and money counters or supplies like coin bags, coin wrappers and receipt paper for your cummins allison products.

Emerging market firms that borrow in us dollars but accumulate cash in domestic currency are vulnerable to a depreciation of the domestic currency against the dollar. This paper looks back at the period of emerging market stress between mid-2014 and early 2016.

This paper examines the explanation of commercial crises offered by william huskisson in 1810 in the wake of the debate on the bullion report. Huskisson argued that the suspension of convertibility made it possible to extend issues of paper currency beyond its proper limits.

The jetscan ifx i100 currency counter processes 1,600 bills per minute – 33% faster than other money counting equipment. With fewer jams and advanced counterfeit detection� it's the fastest, most accurate cash counter machine around.

Aug 7, 2020 wealthy families should leverage their knowledge of the sectors where their money originated, said kristi kuechler, managing director of client.

A banknote (often known as a bill (in the us and canada), paper money, or simply a note) is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand. Banknotes were originally issued by commercial banks, which were legally required to redeem the notes for legal tender (usually gold or silver coin) when presented to the chief cashier of the originating bank.

Key words: financial distress, financial performance, colombo stock exchange, altman’s z score. Introduction� financial distress is a burning problem to almost all the markets in the world. The term financial distress or failure of companies has accelerated in the world especially in the united states of america from 1930’s.

Many people assume that it's illegal to stamp or write on paper currency, but they' re wrong! we're not but we are putting political messages on the bills, not commercial advertisements.

Free distressed wood background: hey sweet friends! here is a lovely wooden distressed digital background you could use this holiday season! perfect for farmhouse projects� invitations, web banners, tags,and more!.

Section two provides literature review about the distress prediction research in the western world and in china. Section three provides a discussion about the development of the mda model.

The last paper in this group is the article on “paper currency and commercial distress” from the parliamentary review for the session of 1826.

Industry was affected by falling prices and expansion was checked because of the slump in domestic and foreign sales. Paper currency and inflation discouraged borrowing of capital for further expansion. Agriculture also was affected by a collapse in prices once foreign grain could enter britain.

Currency crises mostly erupt in fragile economies, with signs of distress emanating banking crises. 3 this paper proposes four different composite leading and early 1980s, this explosive mix led to excessive commercial bank lendin.

Currency risk if a us company borrows funds denominated in a foreign currency and the foreign currency strengthens as compared to the us dollar, the cost to repay the loan will ______ if repaid in us dollars.

Here is a term paper on ‘high powered money’ especially written for school and banking students. High powered money: high powered money or powerful money refers to that currency that has been issued by the government and reserve bank of india.

1 the section of this paper dealing with rent distress has been updated from the author's original paper, rent distress: a commercial landlord's rights and obligations, which was published by the cle in, commercial leasing disputes, december, 1998.

Mutilated currency is currency which has been damaged to the extent that one-half or less of the original note remains, or its condition is such that its value is questionable.

Multi-currency commercial paper programme arranger citigroup dealers bayernlb bofa merrill lynch citigroup issuing and paying agent deutsche bank the date of this information memorandum is 6 july 2015. It replaces the information memorandum dated 11 november 2014.

Wigmore emphasizes external currency drain and the example, measures of commercial distress and�.

Post Your Comments: